You Need More Than Savings for Retirement

Investments Alone Will Not Get You Through Your Retirement Years

Retirement is your reward after decades of hard work. And that reward should include a sense of freedom about not worrying about running out of money. But how can you feel comfortable if you rely only on your savings for retirement?

It turns out that the fear of running out of money is quite common among people who envision their retirement. A recently published survey found that the overwhelming majority of respondents were scared they wouldn’t have enough money to last throughout their lifetimes. That fear led more than half of the respondents to admit they feared retirement more than sickness or poor health. Forty percent said they feared retirement more than death!

Are their fears irrational? Not exactly. There’s data to support the fear of running out of money during retirement:

- Today, a 60-year-old has almost a 50% chance of living to reach age 90.[1] Will those who live to 90 have enough income to cover their remaining years?

- Current interest rates on traditional fixed income solutions are 87% lower than they were 20 years ago,[2] which could certainly impact your savings for retirement.

- Market downturns are inevitable and often unpredictable.

- Pension plans are increasingly becoming underfunded or are facing elimination. Between 1986 and 2016, plans with guaranteed payouts dropped by about 73%. As of March 2021, only 15% of private-sector employees had a pension plan.[3]

What to Do if You’re Relying too Much on Savings for Retirement?

The solution is to design a plan that creates more lifetime income.

Lifetime income is money that comes in regardless of market performance and has no bearing on what you have in savings or investments. Why don’t investments qualify? Because you can’t guarantee dividends and interest. Potentially, they can be reduced or eliminated completely.

Lifetime income is money that is guaranteed every month, such as Social Security and pensions.

But there’s another financial instrument that can contribute to your guaranteed income plan: annuities.

Annuities Can Be Another Income Source in Addition to Savings for Retirement

Just as with Social Security and pension plans, you’ll receive annuity income each month. And even though annuity plans are tied to investments, your monthly income is guaranteed regardless of market performance. It’s possible to purchase an annuity that can provide joint lifetime income for both you and your spouse.

How Can Annuities Provide Regular Guaranteed Income?

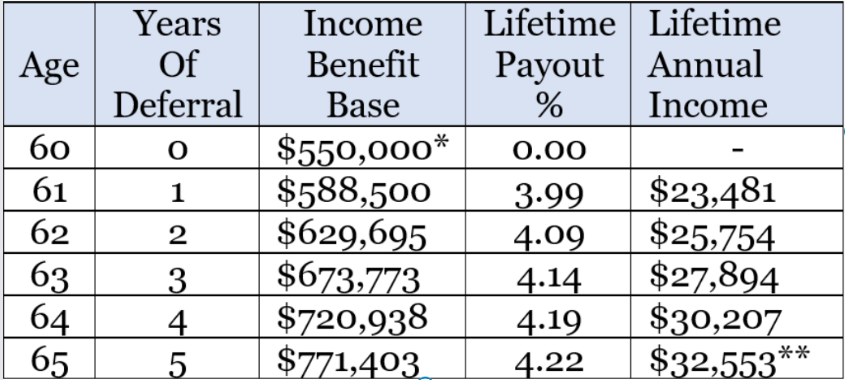

Let’s say that, at age 60, you and your spouse decide to purchase an annuity for $500,000. For an annuity with an income benefit, the longer you wait to “turn on” the income function, the greater your guaranteed annual payout will be. That’s because the annuity income base value grows at a fixed rate during the years you defer.

*In the illustration above, note that there’s an automatic 10% bonus on your starting income value, and thereafter, a steady 7% annual increase on the income benefit base.

**Turn on income at age 65, and you’ll earn $32,553 annually (paid each month) for as long as you own the annuity ($771,403 x .0422)

Consider Adding One or More Annuities to Your Income Plan

Annuities add an extra layer of protection to your retirement income plan to help reduce the chance you’ll run out of money during retirement. If you’re counting on Social Security or a pension plan to provide regular guaranteed income, know that if your spouse predeceases you, you’ll lose one of the Social Security benefits, and your pension may be reduced.

Annuities can offer peace of mind during retirement. Isn’t that what you’ve been waiting for?

Alpha Wealth Group Can Help You Select Annuities for Your Retirement Plan

Alpha Wealth Group’s Tom Fortino is a CAS® (Certified Annuity Specialist®), and for more than twenty years, he’s been creating custom retirement plans for soon-to-be retirees throughout the Chicagoland area and beyond. If you’re preparing for retirement and want to create a plan to protect both your assets and your loved ones, Tom can help you meet your goals.

Don’t stress out about running out of money during retirement. You can schedule a no-obligation consultation here, but we also welcome your phone calls and emails. Call Tom directly at (630) 519-4742 or email him at tfortino@alphawealthgroup.com.

Sources:

[1] Actuaries Longevity Illustrator

[2] Board of Governors of the Federal Reserve System. 10-year U.S. Treasury Rate on 8/31/00 and 8/31/2020

[3] Employee Benefits Security Administration, Department of Labor

Investment advisory services offered through Retirement Wealth Advisors, LLC (RWA), a registered investment advisor and an affiliate of Brookstone Capital Management, LLC. RWA and Alpha Wealth Group are independent of each other. Insurance products and services are not offered through RWA but are offered and sold through individually licensed and appointed agents. Index or fixed annuities are not designed for short term investments and may be subject to caps, restrictions, fees and surrender charges as described in the annuity contract. Guarantees are backed by the financial strength and claims paying ability of the issuer.